By John McBride

The Setting Every Community Up for Retirement Enhancement Act (SECURE Act) went into effect in 2019, resulting in several changes to IRA distribution rules. The age for required minimum distributions (RMDs) increased from 70½ to 72 years and eliminated the previous age limit for contributions to an IRA (as long as you continue working), (1) created the ability to use 529 plan funds to repay up to $10,000 per lifetime in student loan debt, (2) and established a new 10-year rule that impacts the “stretching” of IRA funds after the holder passes away.

The 10-Year Rule

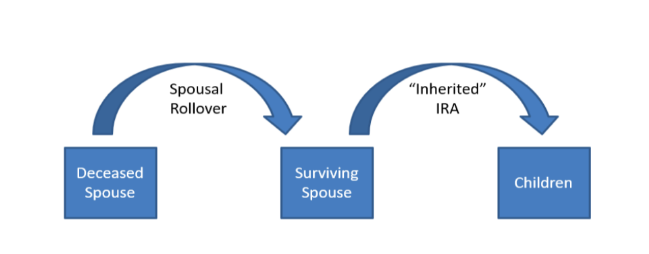

Under the old rules (see figure below), funds from an IRA could be stretched over the life span of a spouse and/or a surviving child, which no longer works under the current rules.

While a surviving spouse can still take advantage of the stretch, children and most other beneficiaries are now subject to the 10-year rule, which stipulates that funds from an IRA must be fully distributed by the end of the tenth year after the original account owner dies. We will now examine a few scenarios to illustrate how the changes may impact a retirement plan.

Spouse-Inherited IRA

When a spouse is named the beneficiary of an IRA, the rules are still treated as before, and the spouse will still be able to distribute over their life expectancy as an “Eligible Designated Beneficiary”. Other examples of this exception to the rule includes a minor child of the IRA owner, disabled individuals, chronically ill individuals, or any named beneficiary who is less than 10 years younger than the IRA owner.

Immediate Disbursement

A beneficiary who receives an IRA inheritance while still working and accumulating assets may elect to take an immediate distribution. This scenario is most likely when the amount of the IRA is small, and the beneficiary’s income is currently in a low tax bracket. Lump Sum distributions from Inherited IRA funds are not subject to the 10% early withdrawal penalty. If the beneficiary expects income to increase over time, then there is little benefit to delaying distributions.

Delayed Distribution

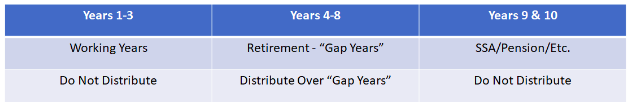

For a beneficiary in the working years, but less than 10 years from retirement age, it may make the most sense to wait until after retirement to draw from the IRA, especially if the beneficiary is earning a high income. In this scenario, a beneficiary might want to align distributions from the inherited IRA with the “gap years,” after retirement but before drawing down other post-retirement income sources such as Social Security and pensions.

Distribution Over 10 Years

A beneficiary who expects to continue working for the next 10 years or more will need to fully distribute the IRA before retiring. The distribution strategy in this case will depend on the beneficiary’s income picture. If the beneficiary’s income varies from year to year, distribution from the IRA may need to be adjusted accordingly. For a beneficiary who expects to earn a steady income over the next 10 years, it may be logical to take a steady distribution over the whole period.

Failure to comply with the 10-year rule for IRA distributions will result in a penalty equal to 50% of the funds remaining in the IRA after the tenth year. (3) The SECURE act did not make any changes regarding non-designated beneficiaries, which are still subject to the old 5-year rule. (4) Depending on your situation, other restrictions or conditions may apply, so be sure to consult your tax professional.

We’re Here To Help

The new 10-year rule may sound like bad news in some cases, but keep in mind that IRA distributions are only one component of your overall financial plan. You will need multiple streams of income that come into play during different stages of your working years and retirement. If you have inherited an IRA or may pass on your IRA to an heir, or if you would like to discuss how we can help you on the path to retirement, reach out to us at 623.251.7282 or email us at john@swa.financial to schedule a meeting. Lastly, watch a replay of our webinar 2021 Investor Outlook to learn more about the SECURE Act and the financial forecast for investors like you.

About Stewardship Wealth Advisors

Stewardship Wealth Advisors is an independent, fee-based comprehensive financial planning firm dedicated to empowering clients to steward their wealth well and maximize their hard work and dedication. With decades of experience, our team of advisors builds a foundational relationship to create a personalized financial plan to help their clients reach their goals and achieve financial independence. To learn more about what we do and how we can help you, connect with us online.

_____________

(1) https://www.irs.gov/retirement-plans/retirement-plans-faqs-regarding-required-minimum-distributions

(2) https://www.savingforcollege.com/article/new-law-allows-529-plans-to-repay-student-loans